Donation Trends in Japan⑧: Corporate Donation (Giving Japan 2015) Reports

Posted on June 07, 2016

by Giving Japan

Corporate donation was ¥698,600 million (2013 fiscal year) and 16.2% of all the corporations has reported as donation expenditures.

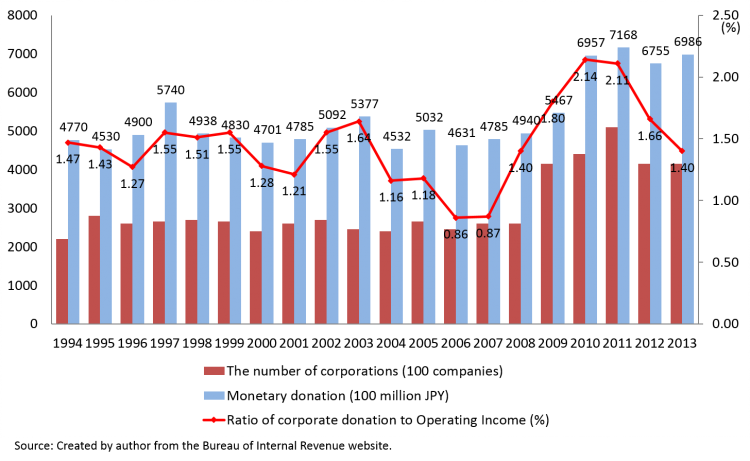

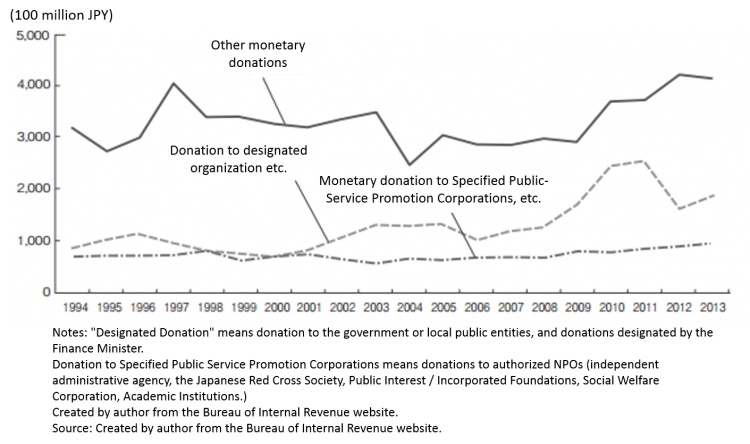

The overall corporate donation* can be estimated from the tax data released by the National Tax Agency. 1,441,492 companies were included in the latest investigation in 2013 fiscal year. The donation expenditures reported by corporations in 2013 fiscal year was about ¥698,600 million, 1.4% of corporate income (National Tax Agency website). The number of companies that have reported donation expenditures was 419,604 corporations, 16.2% of the total of 2,595,903 corporations. In the total donation amount of about ¥698,600 million in 2013, designated donations were ¥187,400 million (26.8%), donation to Specified Public Service Promotion Corporations were ¥96,600 million (13.8%) and other monetary donations were ¥414,600 million (59.3%) (Fig. 1-29, Fig. 1-30).

Table 1-9 Important criteria for donors to consider when making a donation (multiple answers) (by category / by existence of organization to continuously support)

Table 1-9 Important criteria for donors to consider when making a donation (multiple answers) (by category / by existence of organization to continuously support)

Fig.1-30 The breakdown of corporate donation

Fig.1-30 The breakdown of corporate donation

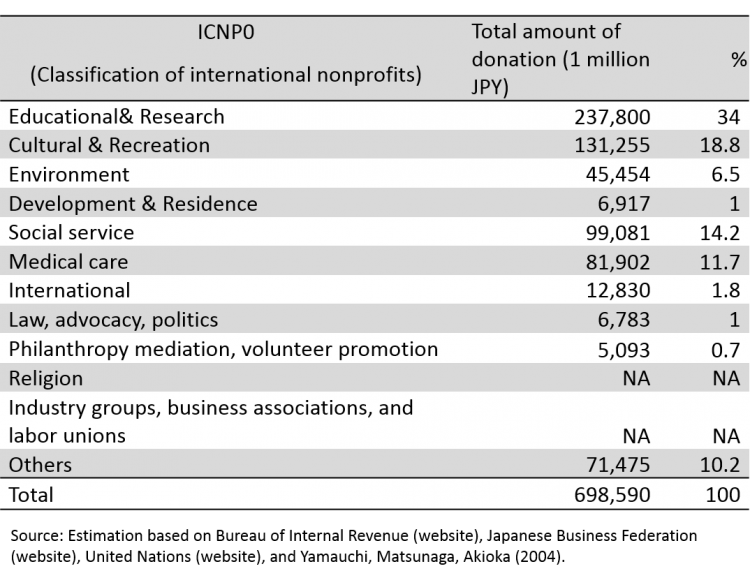

As a result of estimating a scale of corporate donation by category according to the tax data, “social contribution activity survey in the 2013 fiscal year” issued by the Japanese Business Federation (Keidanren) and also using the classification of international nonprofits, Education / research are the highest, ¥237,800 million (34.0%) followed by Culture & Recreation, ¥131,300 million (18.8%), and social service including the support of disaster affected areas, ¥99,100 million (14.2%) (Table 1-10).

Table 1-10 Field composition of corporate donation

Table 1-10 Field composition of corporate donation

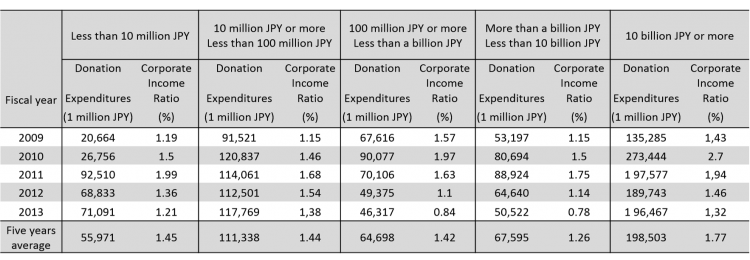

In terms of a trend of corporate donation expenditure by capital, there is an increase from the previous year with companies with less than ¥100 million or ¥10 billion and more; however, there is a decrease in a ratio against corporate income at any level (Table 1-11).

Table 1-11 Transition of donation expenditures to corporate income ratio (by size of enterprise)

Table 1-11 Transition of donation expenditures to corporate income ratio (by size of enterprise)

* In tax data from the National Tax Agency, domestic ordinary corporation (incorporated company (former limited company) excluding suspended or liquidated corporation, alien corporation, intermediate corporation, and special corporation; partnership corporation; limited partnership corporation; associated corporation; cooperative partnership, special purpose company, joint enterprise cooperative, mutual company, medical corporation) is targeted.

Table of Contents

- Index

- 43.6% of people donated money and 24.6% of people donated goods. More than half make a donation a year.

- Four years from the Fukushima earthquake disaster – Donors remains as 40% and the total amount of donations was increased to ¥740,900 million.

- 47.1% of female, 40.3% of male make a donation. More than half of people aged 60 and over make a donation.

- Online donation increases slightly. “Hometown tax donation” and “Gifts with donation” are expected to see a future increase as more people showed an interest.

- “Sympathy to organization” and “Social contribution awareness” are particularly high with donors who make a donation of ¥50,000 or more.

- Important criteria for donors to consider when making a donation – “the use of monetary donation,” “the meaning/purpose of the activity,” etc. ranked high. Those two are viewed more important by donors who have an organization that they wish to support than those who don’t.

- Corporate donation is ¥698,600 million (2013 fiscal year) and 16.2% of all the corporations has reported as donation expenditures.

- Donations are certainly gaining its momentum.

Recent Articles

- Towards a society where children want to embrace life

- The Evolution of Philanthropy: Five approaches shaping contemporary practice

- 25 years of community understanding and moms’ hard work: The activities of Kinutama Play Village

- Connecting memories: Courage found at the film screening of parents’ legal battle after the Great East Japan Earthquake Tsunami

- An NPO project I came across while reflecting on teacher shortages after leaving my teaching job

- To unlock philanthropy’s potential for Japan, we need to understand its meaning